What is an additional prepayment?

An entrepreneur with a business ID can make prepayments for the previous year as additional prepayments. OP Light Entrepreneur service will request additional prepayments on behalf of entrepreneurs, if the accrued prepayments from invoices are over 170 € during the financial year. If the amount of accrued prepayment is less than 170 €, we will return it to entrepreneur.

As our customer, your additional prepayments will be the prepayments accrued from your invoices during the previous financial year.

What does an additional prepayment mean for OP Light Entrepreneurs?

On behalf of our users, we request additional prepayments retrospectively, for the previous financial year. In the January following the financial year, the Tax Administration sends a notification, "Decision, preassessment 2023".

If you receive the aforementioned letter, you do not have to react to the additional prepayment or notification from the Tax Administration. We will handle the entire payment on your behalf and make the additional prepayment to the Tax Administration.

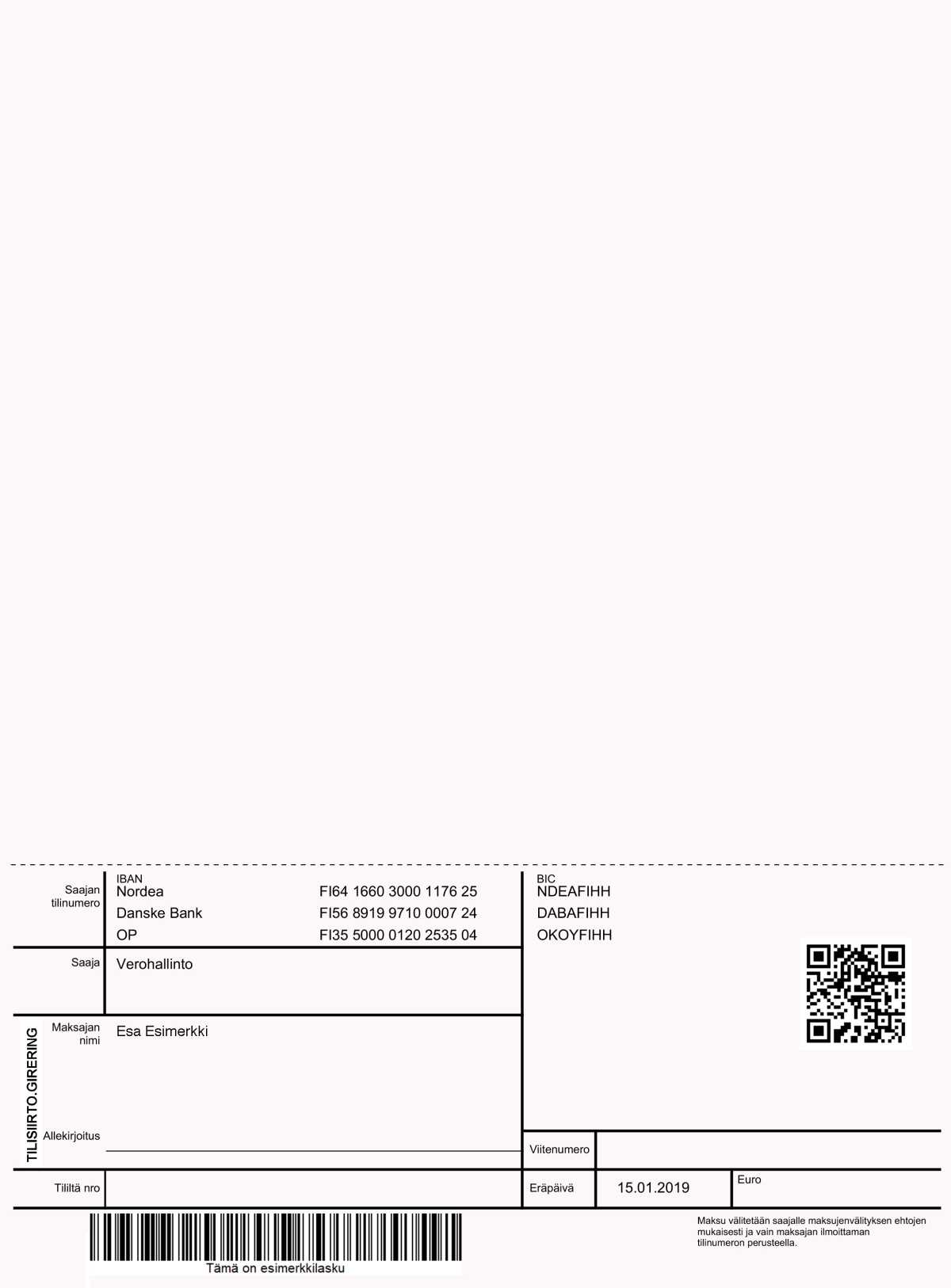

When we have requested additional prepayments, the Tax Administration sends each of our users a separate decision. This is accompanied by a bill which you do not need to pay. We will pay it on your behalf, since it covers the prepayments accrued from the previous year.

What do the prepayment decision and bill look like?

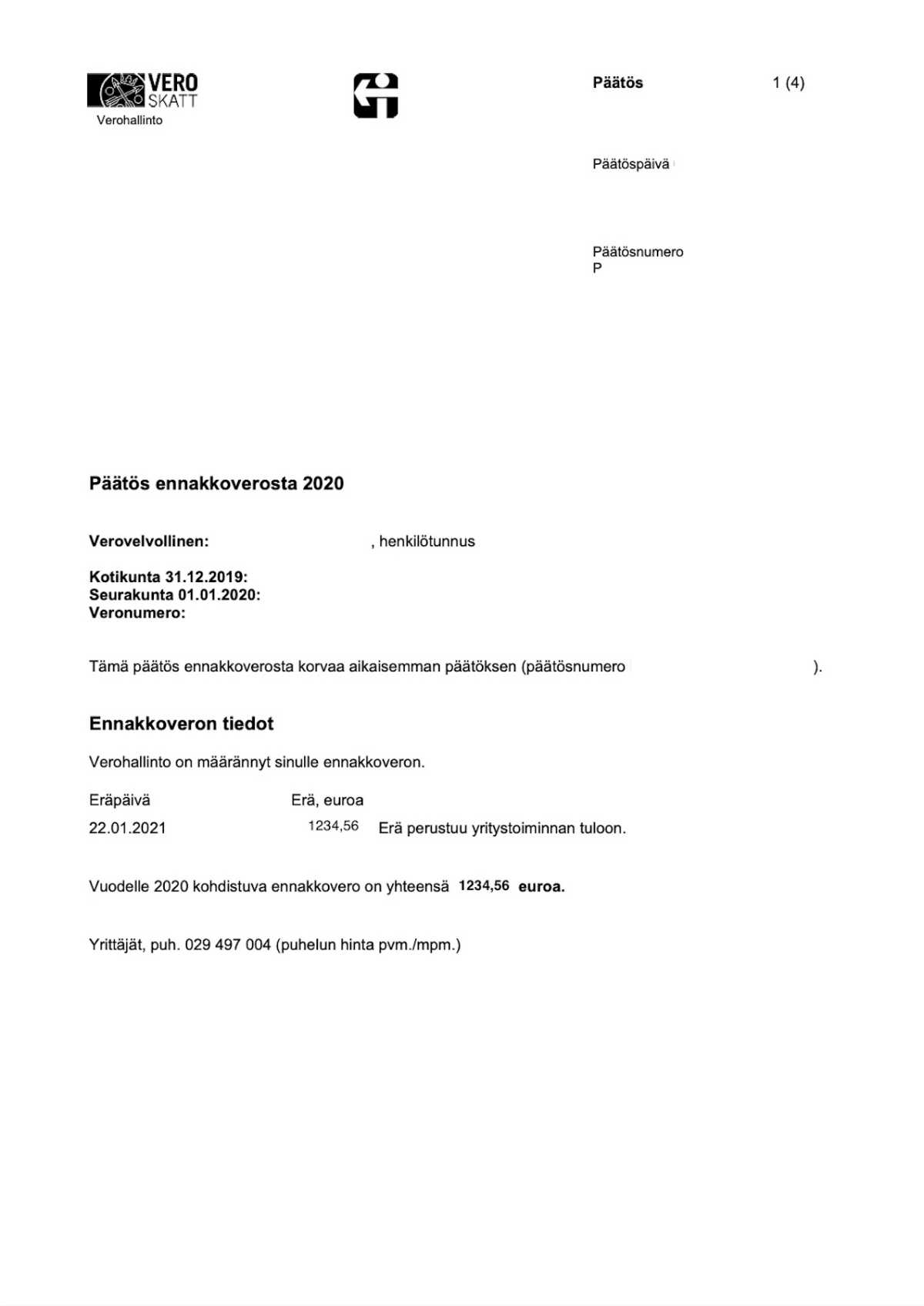

If the following details are included in the letter sent to you, it concerns a decision about an additional prepayment.

- Title "Decision, preassessment 2023"

- The amount shown in the "Vuodelle 2023 kohdistuva ennakkovero on yhteensä" (Total prepayment for 2023) section is the same as the amount on the Transactions tab in your user account. Select the 2023 financial year and compare the "prepayment taxes" section with the amount given in the decision.

If the letter you received includes both of these, you do not need to take further action.

First page of the prepayment decision for 2020 received by the above sample customer. The decision issued for 2023 will look similar to this letter. The letter did not require any action by the entrepreneur.

OP Light Entrepreneur had paid the additional prepayment bill received by this sample entrepreneur before the letter had even been posted. So, there are no more payments to make.

Can I check somewhere that the additional prepayment has been made?

The additional prepayment will also be displayed by the MyTax service on the bill’s due date at the latest. To view all of your company’s tax matters in one place, go to MyTax.

When do we not request an additional prepayment for an entrepreneur?

Note! We will only request additional prepayments if at least 170 € in prepayment taxes have accumulated from your billing. If the prepayment amount is below 170 €, we will repay the amount into your account and not request additional prepayments. You cannot request additional prepayments of less than 170 € from the Finnish Tax Administration.