How are Adobe receipts deducted in accounting?

The Adobe service’s invoices are deductible in business accounting, which are added as expenses in two different ways depending on whether you have ordered the service as a private individual without your Business ID or as a company.

You can deduct Adobe tools in your accounting by adding receipts from the vendor using the “New expense” function. Check the VAT rate of the invoice/receipt on the receipt and add the expense as instructed.

When the VAT ID has been notified to the vendor (VAT 0% reverse charge)

Add an expense like this:

- Add an Adobe cost with the New → expense function.

- Add a receipt/invoice received from Adobe as a receipt

- Select Service

- Select Other operating expenses

- Select From the EU

- Select Reverse VAT rate 25,5 % The VAT rate is selected according to the VAT rate that would be applied to the purchase in Finland.

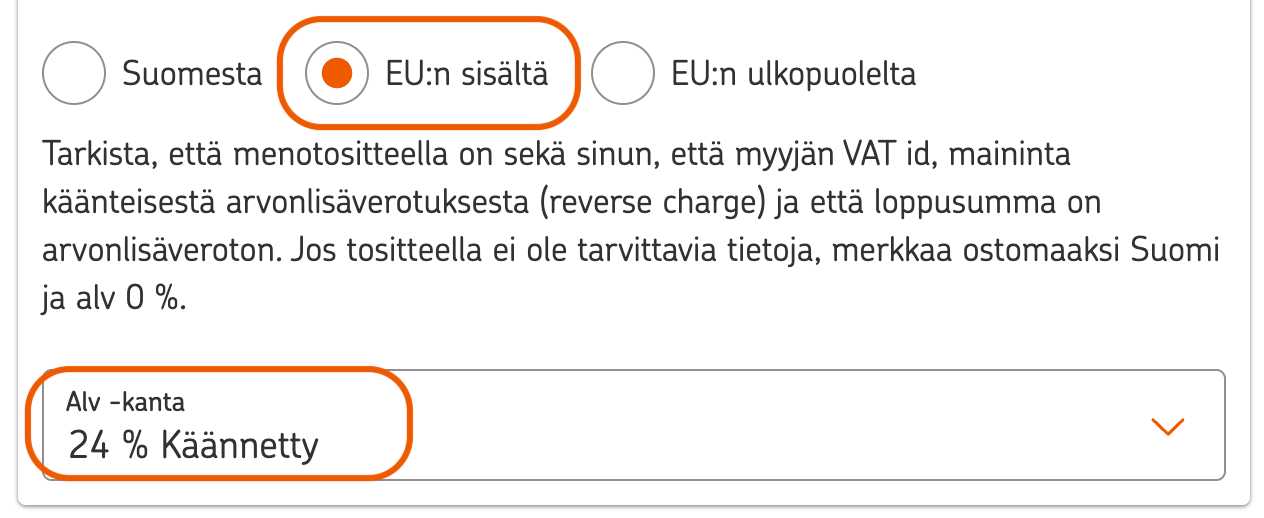

An example of how to add an expense as a reverse acquisition

Select from within the EU and choose the VAT rate of 24% reversed. The VAT rate is chosen according to the VAT rate of the product or service, which would apply in Finland.

When an expense has been acquired as a private individual (without VAT ID)

Add an expense like this:

- Add an Adobe cost with the New → expense function.

- Add a receipt/invoice received from Adobe as a receipt

- Select Service

- Select Other operating expenses

- Select Finland as country of purchase

- Select VAT rate 0 % Foreign VAT cannot be deducted in taxation, which is why the expense is marked as VAT 0%.

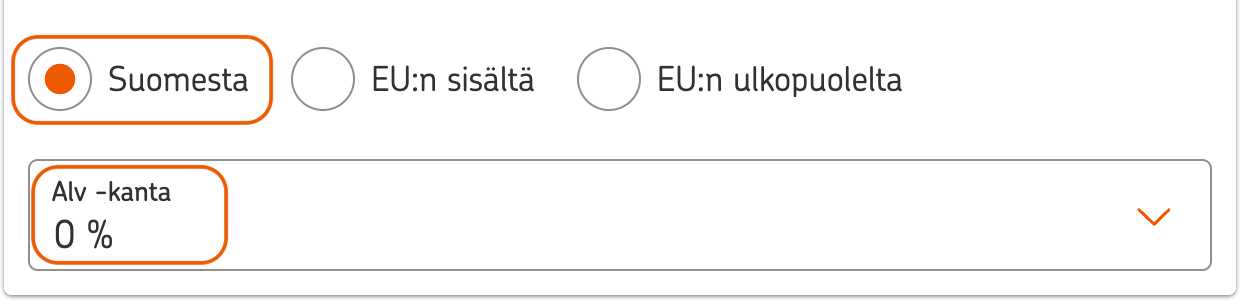

An example of how to add an expense with foreign VAT

Add the expense in accounting with Finland as the country of acquisition and select the VAT rate of 0%, as foreign VAT cannot be deducted.

How do I provide my own VAT ID to Adobe?

You can provide your own VAT ID to Adobe, in which case you will receive the purchase VAT 0%, i.e. you will benefit at the time of purchase. Add your VAT ID number by logging into your Adobe user account according to these [instructions created by Adobe] (https://helpx.adobe.com/en/manage-account/using/update-vat-id-for-eu-countries.html).

VAT ID is only used for business acquisitions

Do not use your VAT ID for private purchases, as reverse charge acquisitions are only used for business acquisitions.