Your reliable partner when you need to invoice your work

Compare services and choose the one that suits you best

OP Light Entrepreneur

Without Business ID

- Become a light entrepreneur without your own business ID

- Agree on a job, send an invoice and receive the money in your account

- We take care of statutory notifications and fees for you

- Possibility of invoicing abroad within the EU

Service charge 5%

No additional fees, no other costs

It’s as easy as that!

1.

Become a light entrepreneur

Create your own business ID or start invoicing easily without your own company by registering for the service.

2.

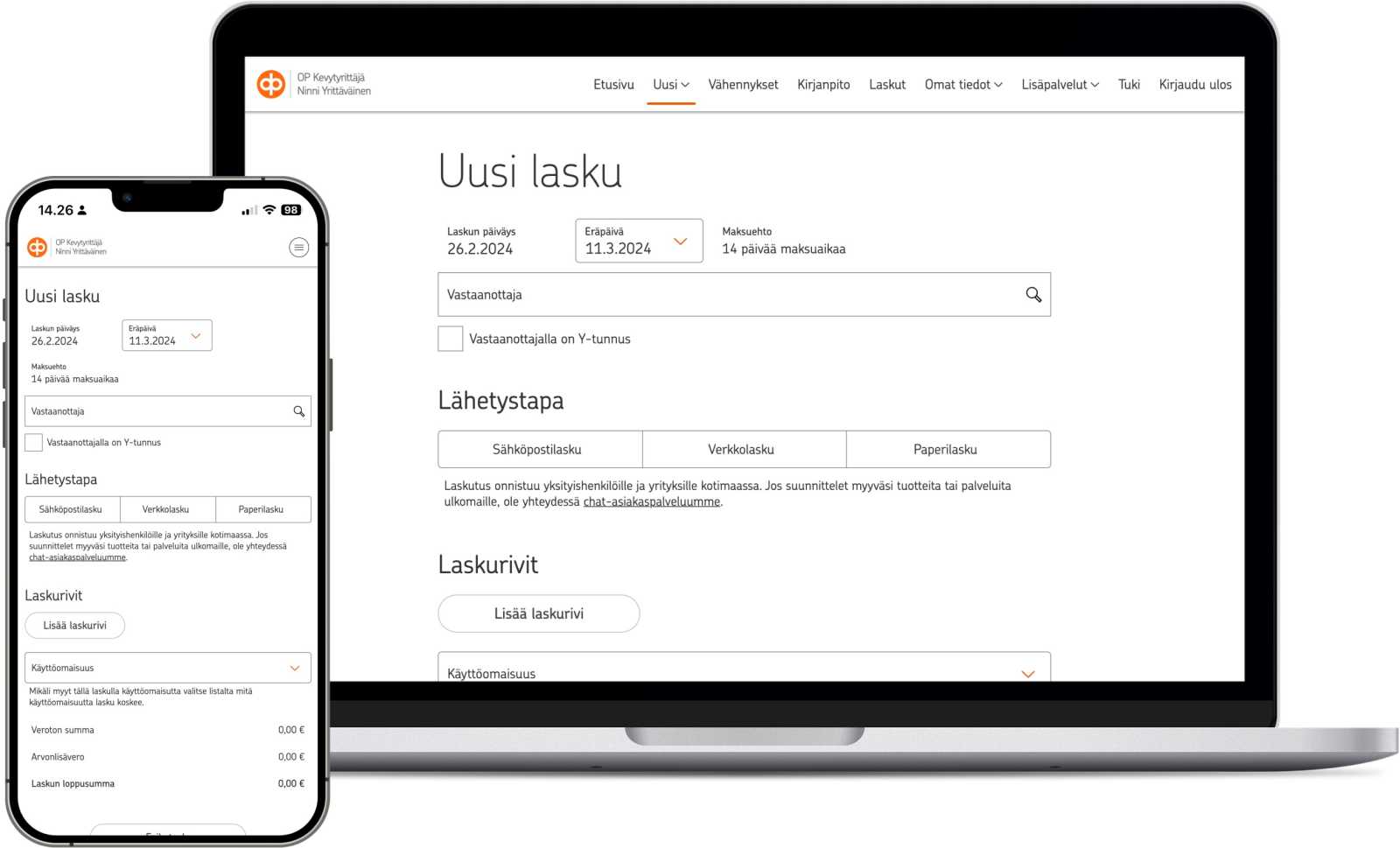

Send invoices

Create an invoice for the work you have done, we will send it to your customer in the way you want.

3.

Money paid into your account

We will withhold taxes and fees, and the rest will be paid directly into your account. You can use the money you receive like a salary.

4.

Take advantage of deductions

Deduct business-related expenses with a business ID or invoice tax-free compensation in the Without Business ID service.

50,000+

business IDs established

1.5+ million

invoices sent

175,000+

resolved issues

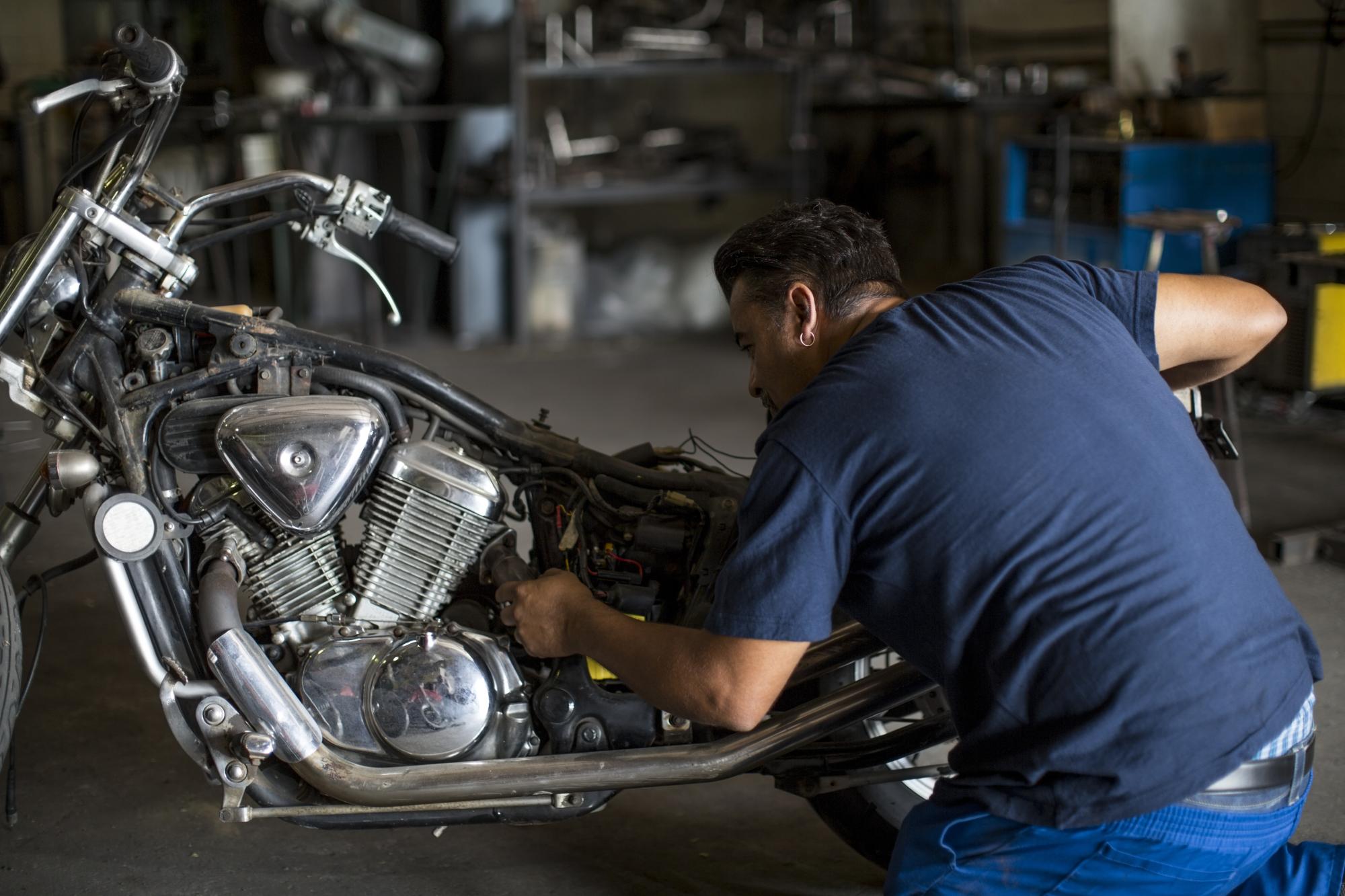

Join skilled professionals

We handle paperwork for over 590 industries and sectors

User experiences

of the OP Light Entrepreneur services

Read user experiences

Anna Sofia Graphic designer and illustrator

I started as a part-time entrepreneur in 2018 through the OP Light Entrepreneur service. Before that, I had used invoicing services, but becomin…

Heidi Photographer

The OP Light Entrepreneur service makes entrepreneurship really easy in terms of invoicing and accounting! I especially like the fact that the s…

Hanna Viita Nurse, aesthetic injection treatments

I started as an entrepreneur (and immediately as a light entrepreneur) in March 2025, and entrepreneurship was completely new to me. I have rece…

Joel Farrier

I started as a private trader in July 2024. I initially used the accounting of another invoicing service, but it didn't meet my needs, so I ende…

Charlotte Nyman Stable worker

I never thought I would become a light entrepreneur doing horse-related tasks alongside my other job. I was really nervous about starting to use…

Compare the differences between OP Light Entrepreneur, OP Light Entrepreneur Without Business ID, and working as a private trader

| OP Light Entrepreneur Without Business ID | OP Light Entrepreneur | Working solo as a private trader | |

|---|---|---|---|

| Business ID | No business ID | Included in the service | Done by the trader, or according to the accountant’s charges |

| Accounting and financial statements | Not required | Included in the service | Done by the trader, or according to the accountant’s charges |

| Recording expenses | Possible through one's own tax return | Yes | Through one's own accounting |

| VAT and tax returns | Not required | Included in the service | Done by the trader, or according to the accountant’s charges |

| Handling of prepayment taxes | The service pays taxes according to the tax card | The service pays taxes as an additional prepayment according to the tax rate | Self-reported and paid |

Open a comprehensive comparison table on light entrepreneurship in its entirety

| OP Light Entrepreneur Without Business ID | OP Light Entrepreneur | Working solo as a private trader | |

|---|---|---|---|

| Entrepreneurial deduction in taxation | No | Yes | Yes |

| Possibility of startup grant | No | Yes, before establishment. | Yes, before establishment. |

| Possibility to register in the Trade Register | No | Yes | Yes |

| Using a corporate account | Not required | May be required by your bank | May be required by your bank |

| Sending invoices | Included in the service | Included in the service | Done by trader |

| Debt collection | Included in the service | Included in the service | Done by trader |

| YEL pension Insurance | Can be acquired through the service | Can be acquired through the service | Done by trader |

| Product retail | No | Yes | Yes |

| Invoicing abroad | Within the EU | No | Done by trader |

| Income handled | As a salary | As business income | As withdrawals for private use |

| Age limit | 15 years | 18 years | 15 years |