How does the service handle taxation?

Updated on:

14.5.2025

Taxes on business income are typically paid as prepayments, meaning advance tax bills issued by the Finnish Tax Administration throughout the year. Taxes for your business activities can also be paid as a supplementary prepayment, which we use in the OP Light Entrepreneur service when withholding and forwarding tax from your invoices.

For invoices paid through the service, a portion based on the tax rate you’ve added will automatically be withheld and paid to the Tax Administration in January as a supplementary prepayment.

What to keep in mind about taxation

When you start as an OP Light Entrepreneur, follow these steps:

1. Estimate your tax rate using your tax card

Calculate an accurate tax rate based on your annual earned income in the tax card field "Pay and fringe benefits". Earned income includes all invoicing made through our service (VAT 0%) and other income from paid work such as salaries. You can use the Finnish Tax Administration’s tax rate calculator or create a new tax card in MyTax.

Note that the tax card includes a field for income subject to prepayment, such as business income. If you enter your business income here instead of under the main salary field, you’ll receive prepayment tax bills directly from the Tax Administration. You will need to pay these bills yourself.

We can handle the tax for your business activities by withholding a percentage of your invoicing for a additional prepayment, until you receive official prepayment bills for your business income.

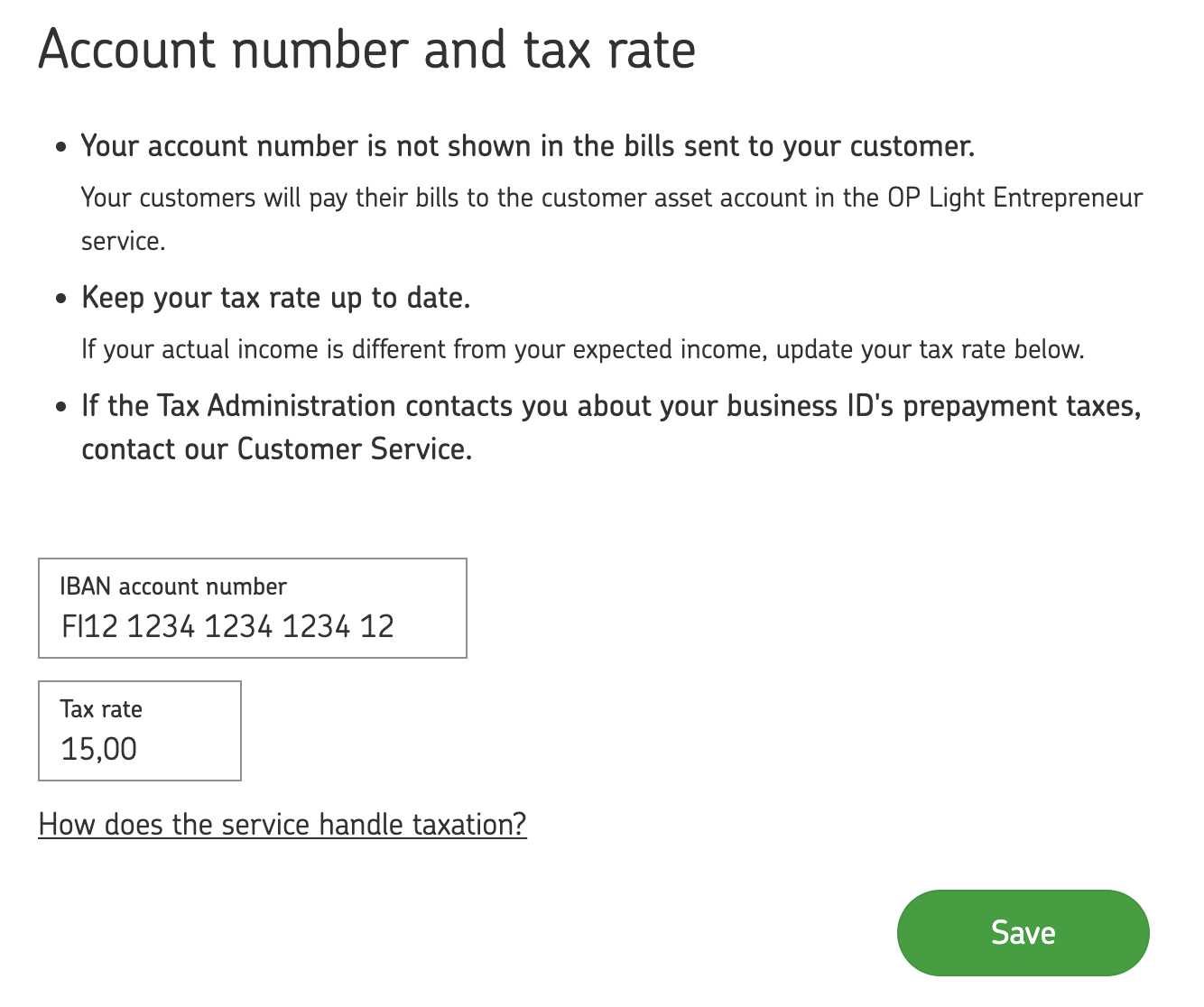

2. Add your tax rate to the OP Light Entrepreneur service

Update your tax rate in our service under My details → Account number and tax rate. You can also add the bank account where you want to receive your business income.

It’s enough to keep your tax rate up to date in our service – you don’t need to send us your tax card.

Tip: We recommend slightly overestimating your tax rate in the service, especially if you pay significant YEL pension insurance. The YEL insurance affects your health insurance contribution, which is not included in the tax rate.

The health insurance contribution is approximately a couple of percent and is based on your YEL income.

3. We handle the withholdings from your sales

We withhold a percentage directly from your realized sales for the purpose of supplementary prepayment. We then apply for and pay the supplementary prepayment on your behalf to the Tax Administration in January of the following year. The OP Light Entrepreneur service automatically handles both the withholding and payment processes.

Read more about supplementary prepayment in our support article.

Note! The service does not make standard prepayments throughout the year. If you are paying advance tax bills issued by the Tax Administration – for example, because you had an active Business ID when you joined the service – set your tax rate to 0% in our system.

OP Light Entrepreneur’s tax rate

As an OP Light Entrepreneur, you only need to estimate your total annual earned income and calculate a new tax rate based on that. Earned income includes all invoicing done through our service (VAT 0%) and any other employment income.

Example of tax rate

Example: Miikka does photography gigs in his spare time and estimates he will invoice €4,500 over the year. He also works full-time at another company and earns €35,000 annually from that job.

When ordering his tax card, Miikka adds his estimated invoicing and salary (4,500 + 35,000 = 39,500 euros) and enters this as his earned income on the tax card. This gives him the correct tax rate.

Also consider possible VAT relief in the tax rate

If you have been an entrepreneur in the previous year and received VAT relief in February of the current year, include it in your income. VAT relief is taxable income and should be considered in your tax percentage. The final VAT relief was issued for the year 2024, affecting 2025 earned income.

If Miikka received €300 in VAT relief from 2024, he should add this amount on top of his invoicing and salary to ensure his tax rate is as accurate as possible.

You can calculate your new tax rate at vero.fi/omavero

The final tax rate is calculated by adding together the salaries from main employment and invoicing as a light entrepreneur. The total amount should be entered in the “Salaries and fringe benefits” field of the tax card. So don’t just guess your business income – unless you want to pay prepayment tax bills directly to the Tax Administration.

Remember to monitor your income ceiling during the year. You can increase or decrease your tax rate in the service anytime if your income estimate changes significantly.

Also keep in mind that your taxes are based on your total income, and income from OP Light Entrepreneur is part of this total. If too much tax is withheld compared to your earnings, you’ll receive a refund. If too little is withheld, you’ll have back taxes to pay. In the end, your tax is based on your income.

By keeping your tax rate updated in the service and on your tax card, you avoid surprises in your tax decision later.

How do I change my tax rate in the service?

After registering for the service, add your tax rate to your user account as follows:

- Click on the “My details” section in the top navigation bar of your user account

- In the drop-down menu, select “Account number and tax rate”

- Add the tax rate to the appropriate field. You do not need to add an additional withholding rate.

- Finally, click “Save”

You can then send your first invoice. You do not need to send us your tax card.

When your customer pays your invoice, we withhold tax based on your current tax rate. If you update the tax rate before the payment is received, we will apply the updated rate.

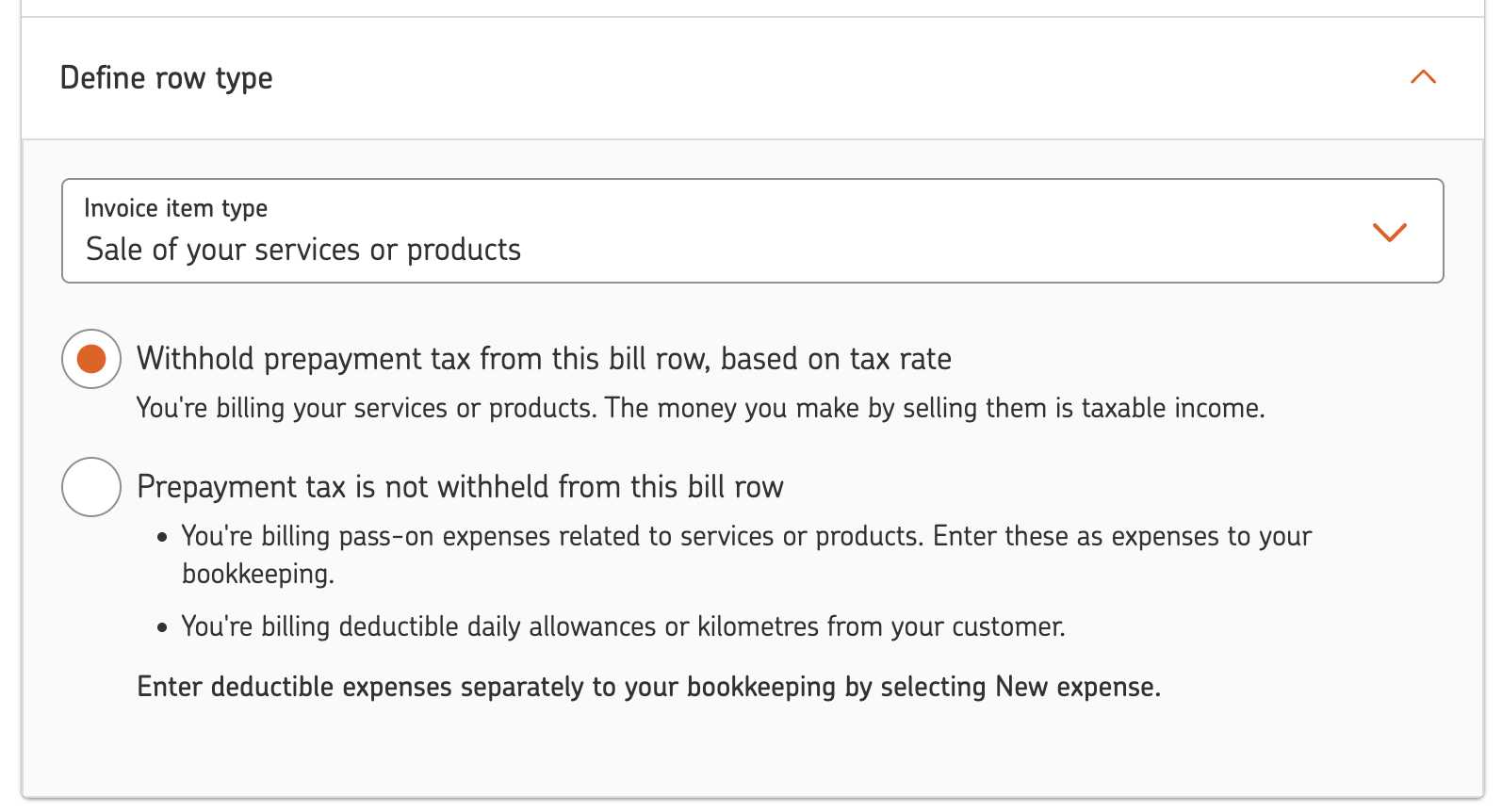

You can also choose not to withhold tax from specific invoice rows

For example, when invoicing for reimbursable materials or mileage, you can select the Define item type option for the invoice row and mark that no tax should be withheld for that item. This setting is found at the bottom of the invoice row.

How to choose tax withholding per invoice row?

Withhold tax from an invoice row when:

- You are invoicing for your own work or for products that are taxable income.

- You are invoicing for products or services with significant profit margin.

Choose Do not withhold tax for this invoice row when:

- You are invoicing resold products or services that you’ll enter as expenses in your bookkeeping.

- You are invoicing deductible per diems or mileage from your customer.

Log deductible expenses separately in the bookkeeping section using the New expense function. Expenses are not automatically carried over from the invoice rows to bookkeeping.

Avoid back taxes by keeping your tax rate up to date

Once again, remember that your taxes are based on your overall income and your OP Light Entrepreneur earnings are part of that. If too much is withheld, you’ll receive a refund. If too little, you’ll owe back taxes. By keeping your tax rate up to date, you avoid large surprises – whether refunds or taxes owed.

OP Light Entrepreneur’s value added tax (VAT)

As an OP Light Entrepreneur, you operate as a sole trader. You invoice your customers with or without VAT, depending on whether you’re registered for VAT and whether the VAT liability criteria are met. The general VAT rate is 25.5%, but a reduced VAT rate may apply depending on your industry and the service or product sold.

We’ve created a dedicated article on VAT. Read more about VAT here.