A quick guide in interpreting tax decisions for OP Light Entrepreneurs

Did you receive a pre-completed tax return from the Tax Administration in the mail—or if you're a true digital native, it might have just popped up in your MyTax – promising you a hefty tax refund? However, did you later receive a gruesome tax decision, in which these juicy tax refunds had turned into back taxes? Does the Tax Administration demand even more taxes to be paid, even though prepayments were withheld from your OP Light Entrepreneur income throughout last year? Were you dismayed to find that the home office deduction you had added to our service was not reflected in your tax decision?

Is taxation causing you anguish and heart palpitations? Don't worry—this article will answer these questions and at the same time help you to interpret these letters from the Tax Administration from the perspective of a self-employed person!

With a pre-completed tax return I was getting a refund of €500 and now the refundable amount on the tax return is less, why?

On the pre-completed tax return, business income and expenses had not yet been added, as they were not filed until later in the spring on the business tax return (Form 5).

If you have accrued more than €170 in prepayments, we have paid the accrual as an additional prepayment to the Tax Administration. However, the income on the pre-completed tax return has not yet taken into account your business income, which means that the taxes you have paid are too high in relation to your income, in which case you are incorrectly getting too much refunded.

However, the tax decision has taken into account additional prepayments paid and business income. For this reason, possible refund in the tax decision is different from the pre-completed tax return, which does not include all business income.

Where can I see my business income on my tax decision?

Your business income and deductions are summed up in the tax decision under "Business result". A 5% entrepreneur deduction has been automatically deducted from this result.

I do not see any deductions or expenses on the tax decision, have you reported them to the Tax Administration?

The tax decision only shows the final result after deduction of expenses and other deductions such as home office deduction and kilometer allowances. For more details on the information declared for business operations, check out the business tax return. You can find your tax return in early spring in your MyTax.

Where is the home office deduction on the tax decision?

You can claim the home office deduction either on your business tax return through our service, or on your personal tax return. If you have claimed the home office deduction through our service, it is not itemized on the tax decision but deducted directly from the business’ taxable result. The deduction made on your personal tax return can be seen on your tax decision under the heading "Expenses for the production of wage income".

Why have you not paid my prepayments?

We have applied for additional prepayments according to the accrual of your tax rate which you have set in the beginning of the year. We messaged this by email in January. If your tax accrual has been less than €170, we have not been able to apply for additional prepayments in accordance with the Tax Administration's policy, in which case we have refunded the accrued prepayments back to you.

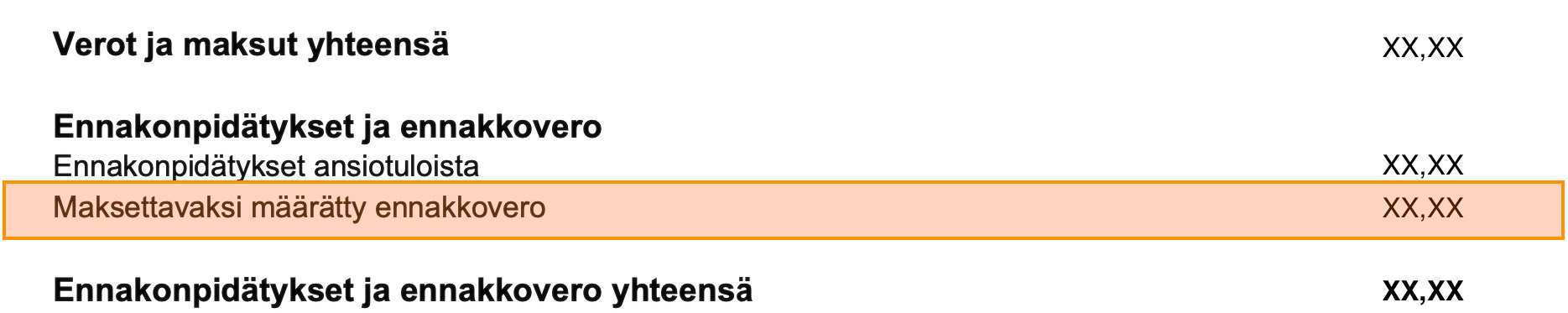

If you had overdue tax debts, the additional prepayments we paid may have been applied to them, as the Tax Administration always applies payments to the oldest debt, which is beyond our control. In this case, you will have to pay any possible back taxes yourself. On your pre-completed tax return and tax decision, the additional prepayment can be seen under "Prepayment due" (see image below).

Why did I receive back taxes, even though I have a tax rate in your service?

It is likely that your tax rate was too low in our service, or that it was not your income from the service that caused the back taxes, but your overall income. Possible reasons for a too low of a tax rate could be higher than expected business income or lower expenditure. If you received a threshold relief for 2022, this has been added to your taxable income for 2023. Your entrepreneurial income as a private trader is earned income that should be included on your tax card to ensure the correct tax rate.

The tax decision you receive is a whole, which is affected by earned income, capital income, and business income. Earned income includes wage income, benefits, pensions, and business income. Benefit income includes study grants, unemployment benefits, and start-up grants. In general, some form of withholding tax is automatically withheld from benefit income, but nowadays, for example, no tax is withheld from study grants and they must be accounted for separately on the tax card. In addition, the 25% automatic withholding tax on benefit income may be too low, leading to back taxes. Also capital income, such as capital gains or dividends, may have caused back taxes. If you receive capital gains, you should request prepayments on them.

In short, if your tax accrual has been too high in relation to your income, you receive tax refunds. Similarly, if your tax accrual is too low, you may receive back taxes. So, in the end, you only pay taxes in proportion to your income. If you need help interpreting your tax decision, we recommend contacting the Tax Administration by phone or via MyTax chat, as they will be able to interpret your tax decision as a whole.

I received a message from MyTax that I should pay back taxes. What do I do?

You have to pay the back taxes yourself according to the invoice sent by the Tax Administration. You can check the tax decision to see your income and deductions that may have caused the possible back taxes.