Luotettava kumppanisi, kun sinulla on tarve laskuttaa työstäsi

Vertaile palveluita ja valitse itsellesi sopivin

OP Kevytyrittäjä

Y-tunnukseton

- Ryhdy kevytyrittäjäksi ilman omaa Y-tunnusta

- Sovi työkeikasta, lähetä lasku ja vastaanota rahat tilillesi

- Hoidamme lakisääteiset ilmoitukset ja maksut puolestasi

- Mahdollisuus ulkomaanlaskutukseen EU:n sisällä

Palvelumaksu 5 %

Ei lisämaksuja, ei muita kuluja

OP Kevytyrittäjä

- Saat Y-tunnuksen ja sen tuomat edut hetkessä ilmaiseksi

- Hoidamme kirjanpidon, veroilmoitukset ja maksut puolestasi

- Hyödynnä yrittäjän veroedut ja vähennysmahdollisuudet

- Pienimuotoisella toiminnalla voit laskuttaa halutessasi ilman alvia

Palvelumaksu 5 % + alv

Ei lisämaksuja, ei muita kuluja

Näin helppoa se on!

1.

Liity kevytyrittäjäksi

Perusta oma Y-tunnus tai aloita laskuttaminen helposti ilman omaa yritystä rekisteröitymällä palveluun.

2.

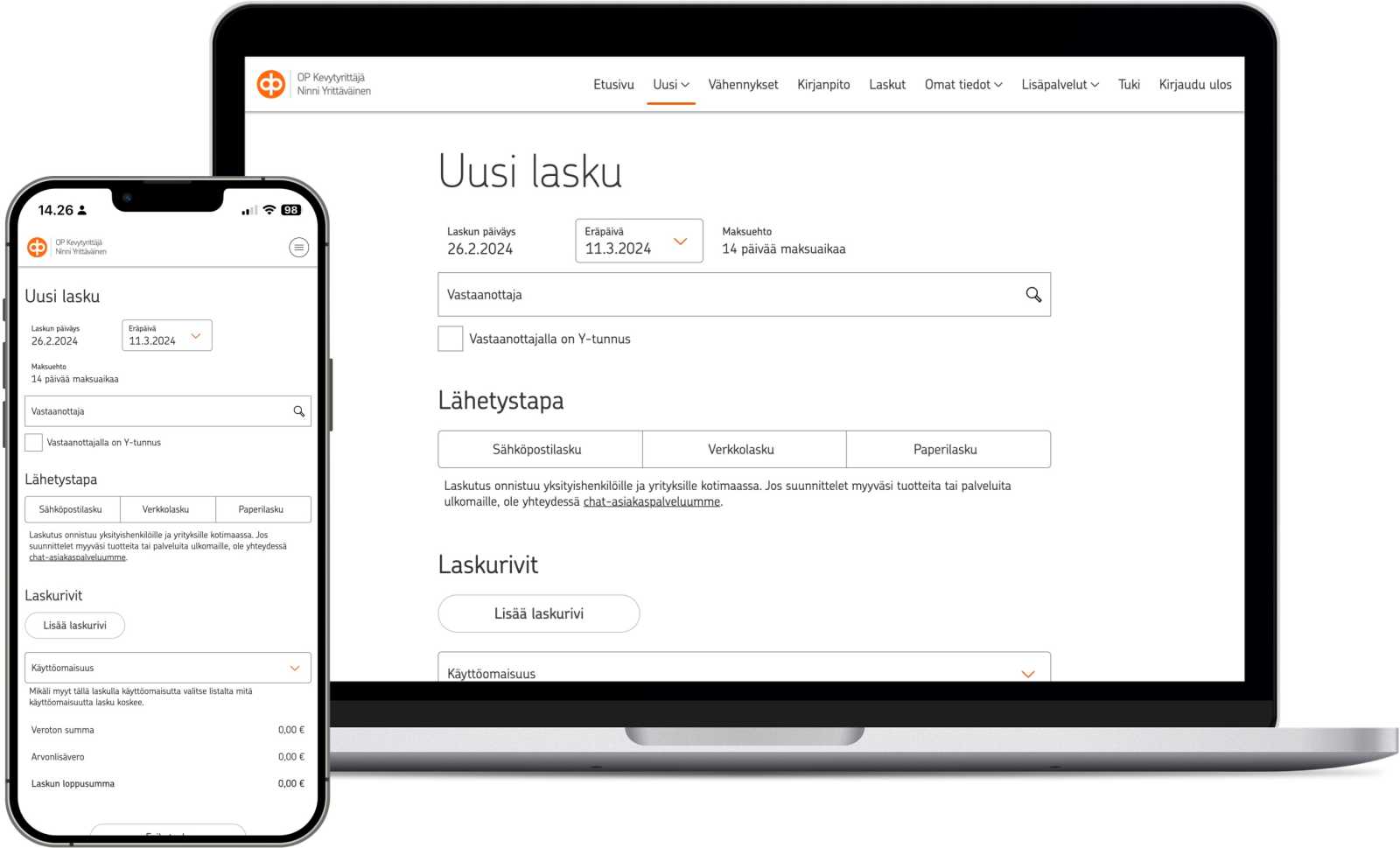

Lähetä laskuja

Tee lasku tekemästäsi työstä, lähetämme sen haluamallasi tavalla asiakkaallesi.

3.

Rahat tilillesi

Pidätämme verot ja maksut, loput maksamme edelleen tilillesi. Voit käyttää saatua rahaa kuten palkkaa.

4.

Hyödynnä vähennykset

Vähennä yritystoimintaan liittyvät menot Y-tunnuksella tai laskuta verovapaita korvauksia Y-tunnukseton-palvelussa.

50 000+

perustettua Y-tunnusta

1,5+ miljoonaa

lähetettyä laskua

175 000+

ratkaistua pulmaa

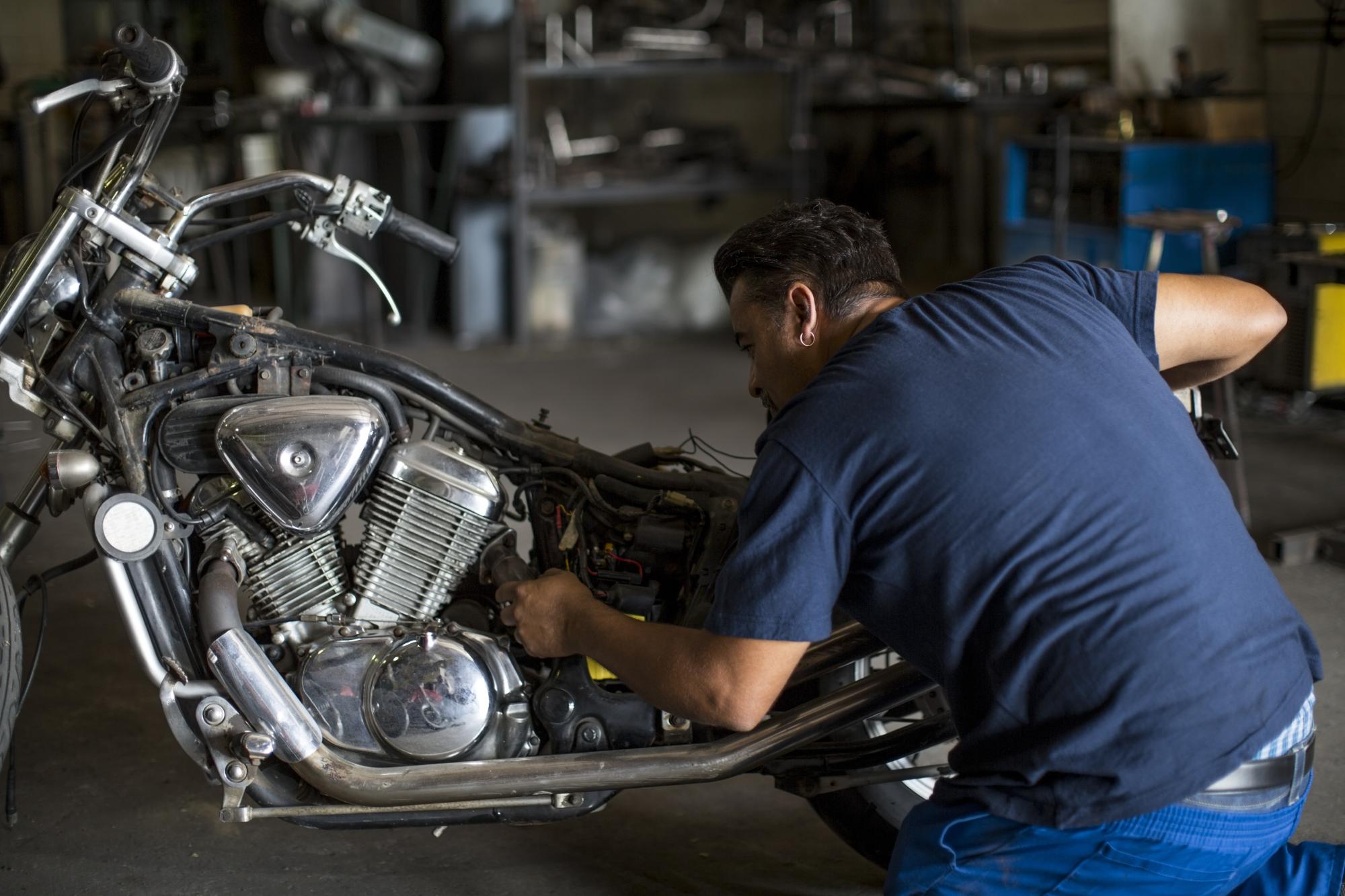

Liity osaavien ammattilaisten joukkoon

Hoidamme yli 590 toimialan paperityöt

Inspiroidu kevytyrittäjätarinoista

Käyttäjien kokemuksia

OP Kevytyrittäjä -palveluista

Lue käyttäjien kokemuksia

Heidi Valokuvaaja

OP Kevytyrittäjä -palvelu tekee yrittämisestä kyllä todella helppoa laskutuksen ja kirjanpidon puolesta! Pidän erityisesti siitä, että sivut ova…

Hanna Viita Sairaanhoitaja, esteettiset pistoshoidot

Aloitin yrittäjänä (ja heti kevytyrittäjänä) maaliskuussa 2025 ja yrittäjyys oli aivan uutta minulle. Olen saanut valtavasti hyviä neuvoja yritt…

Charlotte Nyman Tallityöntekijä

En ikinä uskonut ryhtyväni kevytyrittäjäksi heppahommiin oman toisen työni ohella. Jännitti tosi paljon alkaa käyttämään jotain laskutuspalvelua…

Joel Kengittäjä

Perustin toiminimen heinäkuussa 2024. Otin kirjanpidon aluksi toisesta laskutuspalvelusta, mutta se ei vastannut tarpeitani ja päädyin siis vaih…

Anna Sofia Graafinen suunnittelija ja kuvittaja

Aloin sivutoimiseksi yrittäjäksi vuonna 2018 OP Kevytyrittäjä -palvelun kautta. Sitä ennen olin käyttänyt laskutuspalveluita, mutta toiminimiyri…

Vertaile OP Kevytyrittäjän, OP Kevytyrittäjä Y-tunnuksettoman ja toiminimiyrittäjyyden eroja

| OP Kevytyrittäjä Y-tunnukseton | OP Kevytyrittäjä | Toiminimiyrittäjyys itse tehtynä | |

|---|---|---|---|

| Y-tunnus | Ei Y-tunnusta | Sisältyy palveluun | Itse hoidettava tai kirjanpitäjän hinnaston mukaan |

| Kirjanpito ja tilinpäätös | Ei tarvita | Sisältyy palveluun | Itse hoidettava tai kirjanpitäjän hinnaston mukaan |

| Kulujen lisääminen | Mahdollista omalla veroilmoituksella | Kyllä | Oman kirjanpidon kautta |

| Alv- ja veroilmoitukset | Ei tarvita | Sisältyy palveluun | Itse hoidettava tai kirjanpitäjän hinnaston mukaan |

| Ennakkoverojen hoito | Palvelu maksaa verot verokortin mukaisesti | Palvelu maksaa ennakkoverot veroprosentin mukaisesti | Itse ilmoitettava ja maksettava |

Avaa kattava vertailutaulukko kevytyrittäjyydestä kokonaisuudessaan

| OP Kevytyrittäjä Y-tunnukseton | OP Kevytyrittäjä | Toiminimiyrittäjyys itse tehtynä | |

|---|---|---|---|

| Yrittäjävähennys verotuksessa | Ei | Kyllä | Kyllä |

| Mahdollisuus starttirahaan | Ei | Kyllä, ennen perustamista. | Kyllä, ennen perustamista. |

| Mahdollisuus rekisteröityä kaupparekisteriin | Ei | Kyllä | Kyllä |

| Yritystilin käyttäminen | Ei vaadita | Käyttämäsi pankki voi vaatia | Käyttämäsi pankki voi vaatia |

| Laskujen lähettäminen | Sisältyy palveluun | Sisältyy palveluun | Itse hoidettava |

| Perintä | Sisältyy palveluun | Sisältyy palveluun | Itse hoidettava |

| YEL-vakuutus | Mahdollisuus hankkia palvelun kautta | Mahdollisuus hankkia palvelun kautta | Itse hoidettava |

| Tuotteiden jälleenmyynti | Ei | Kyllä | Kyllä |

| Ulkomaanlaskutus | EU:n sisällä | Ei | Itse hoidettava |

| Tulot käsitellään | Palkkana | Yritystulona | Yksityisottoina |

| Ikäraja | 15 vuotta | 18 vuotta | 15 vuotta |