Become a light entrepreneur

Our service is perfect for new and existing private traders, no matter who they bank with.

Become a light entrepreneur with Business ID

HThe easiest way to invoice and enjoy all the tax benefits that come with a business ID. Perfect for both new and existing private traders.

- Tax deduct your business-related expenses.

- With business ID, you will receive VAT relief.

- With the entrepreneur deduction, 5 % of your income will be tax-free.

- You can apply for start-up grant.

- We will handle your tax returns and tax payments on your behalf.

Invoice without Business ID

Take your first steps as a light entrepreneur without setting up a business ID, or invoice occasionally with no commitments.

- No commitments, you can send a single invoice without setting up an own business ID.

- You only invoice for occasional work gigs.

- Extra income alongside work, study, or unemployment benefits.

Over 25,000 light entrepreneurs already trusts OP Light Entrepreneur services

The main reason for me to engage in light entrepreneurship was to earn extra income and maintain my carpenter skills. As a novice entrepreneur, bookkeeping and tax matters seemed challenging, so it was easy to choose the OP Light Entrepreneur service, where these matters were taken care of, and my questions were answered.Juuso, Carpenter

I started as an OP Light Entrepreneur years ago when I was asked to take on the role of a social media strategist for a company. That's when I realized I could easily offer my services to other businesses as an OP Light Entrepreneur, and also invoice influencer collaborations through the service. Joining Light Entrepreneur service became necessary when I had accidentally turned my hobby into a business. As a student, the additional earnings as an OP Light Entrepreneur have been extremely important.Heini, Social media strategist

OP Light Entrepreneur is an easy-to-use and straightforward service. I invoice my company's (umba.fi) gigs, presentation, and consulting fees conveniently with e-invoices. It works!Antti Vuorela, Umba.fi, Director, Performer, Digital Specialist

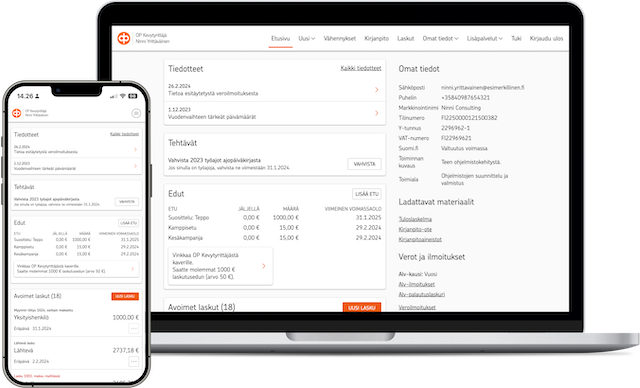

Forget the paperwork

We'll handle the paperwork, tax returns and tax payments on your behalf, leaving you to do what you do best – productive work.

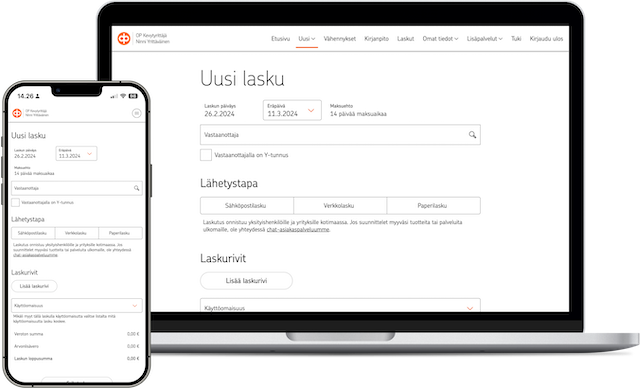

The easy way to send bills

With our service, sending bills is easy and free of charge. Just tell us who you are billing, and for what — we’ll handle the rest for you.

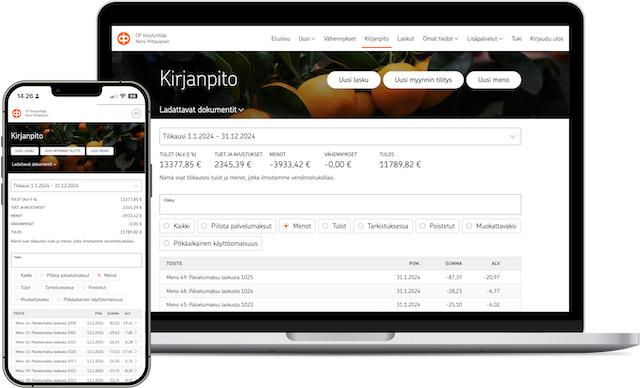

Automatic bookkeeping

Outgoing and incoming bills and payments are automatically entered in bookkeeping. You can also enter cash sales in the accounts. We automatically make the appropriate tax deductions as you add business expenses.

Payments are clear

We charge a service fee (+ VAT 24 %) of 5 % of your sales before VAT. The rest is paid into your account.

The service charge is only paid on net sales of up to 30 000 euros. If your net sales exceed 30 000 euros, you’ll pay no further service fees for the year in question.

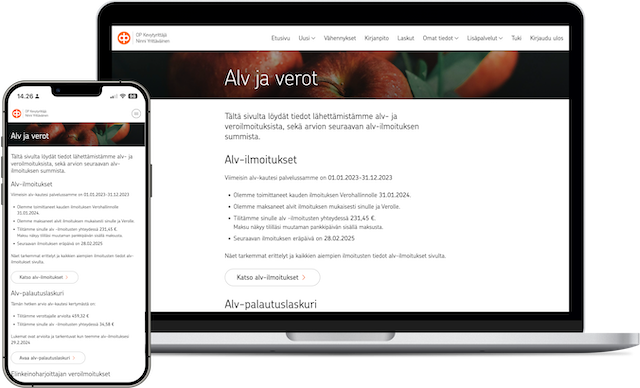

We will handle taxes

We withhold taxes and VAT on your behalf from actual sales and pay them on your behalf.

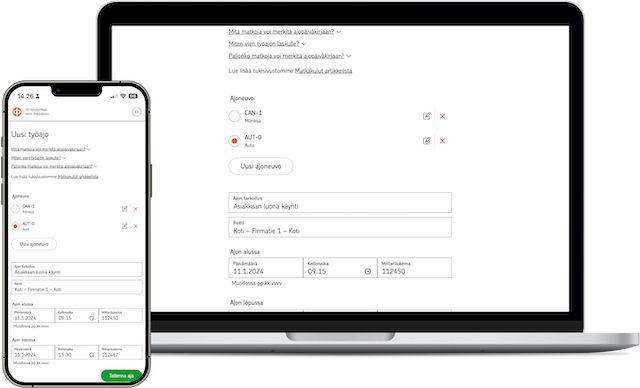

Driving log

Free driving log to easily keep track of deductible worktrips. Kilometre deductions are automatically calculated and reported on the tax return.

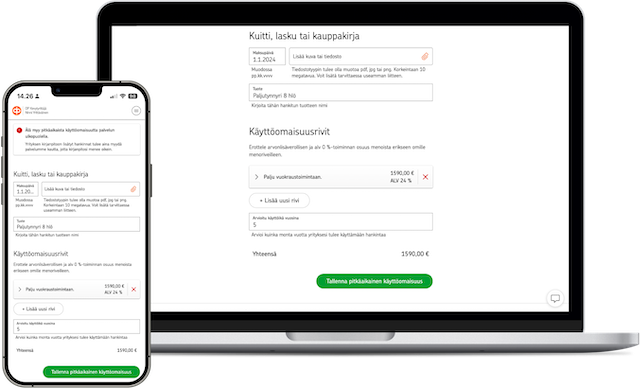

Long-term assets

You can deduct machinery and equipments, such as a 3D printer or vehicle lift, in accounting up to 30,000 € in the service.

Who does light entrepreneurship suit?

Light entrepreneurship is the right choice for you when

- You want to provide services for consumers/other businesses

- You create products, such as artworks, for sale

- You want freedom to manage your work and time

- You want to focus on your business and outsource the paperwork to us.

Compare the differences between private trade and OP Light Entrepreneur with or without a Business ID

Bookkeeping done by oneself

Without a Business ID

OP Light Entrepreneur

Business ID

Self-managed or according to the accountant's price list

No

Included in the service

Income is processed by

Personal withdraw

As a salary

As business income

Deduction of business expenses

Self-managed or according to the accountant's price list

As expenses for the production of income on the tax return

As a expense for the production of income.

Included in the service

Deducting business expenses

VAT deductions and reliefs

Self-managed or according to the accountant's price list

No

Included in the service

Open a comprehensive comparison table of light entrepreneurship entirely.

Bookkeeping done by oneself

Without Business ID

OP Light Entrepreneur

Possibility for start-up grant

Yes

No

Yes

Accounting

Self-employed is managing himself or outsources

–

Included in the service

Opportunity to register in the trade register

Yes

Not possible

Yes

Invoicing service

Self-managed

Included in the service

Included in the service

Financial statement

Self-managed or according to the accountant's price list

No need

Included in the service

How does accounting work in OP Light Entrepreneur? (in Finnish target: _blank)

Collection

Self-managed

Included in the service

Included in the service

How to put an unpaid invoice for collection? (in Finnish target: _blank)

Self-employed persons’ pension insurance (YEL)

Self-managed

Opportunity to acquire through the service

Opportunity to acquire through the service

Other insurances

Self-managed

Not included

Not included

Resale of products

Yes

No

Yes

International invoicing

Possible

Yes

For EU area businesses only.

No

Construction industry invoicing

Possible

Yes

Yes

Entrepreneur deduction in taxation

Yes

No

Yes

VAT and tax returns

Self-managed or according to the accountant's price list

No need

Included in the service

Handling of prepayment taxes

Self-declared and payable

According to the tax card

The service pays taxes to the Tax Administration.

According to the tax percent

The service pays taxes to the Tax Administration as an additional prepayment at the end of the year.

Age limit

With parental permission as a minor.

18 years

18 years

Adding expenses

Possible through your own bookkeeping.

Not possible

Yes

Construction work

Yes

Yes

For private and businesses.

Yes

For private and businesses.

| Bookkeeping done by oneself | Without a Business ID | OP Light Entrepreneur | |

|---|---|---|---|

| Business ID | Self-managed or according to the accountant's price list | No | Included in the service |

| Income is processed by | Personal withdraw | As a salary | As business income |

| Deduction of business expenses | Self-managed or according to the accountant's price list | As expenses for the production of income on the tax return As a expense for the production of income. | Included in the service Deducting business expenses |

| VAT deductions and reliefs | Self-managed or according to the accountant's price list | No | Included in the service |

Open a comprehensive comparison table of light entrepreneurship entirely.

| Bookkeeping done by oneself | Without Business ID | OP Light Entrepreneur | |

|---|---|---|---|

| Possibility for start-up grant | Yes | No | Yes |

| Accounting | Self-employed is managing himself or outsources | – | Included in the service |

| Opportunity to register in the trade register | Yes | Not possible | Yes |

| Invoicing service | Self-managed | Included in the service | Included in the service |

| Financial statement | Self-managed or according to the accountant's price list | No need | Included in the service How does accounting work in OP Light Entrepreneur? (in Finnish target: _blank) |

| Collection | Self-managed | Included in the service | Included in the service How to put an unpaid invoice for collection? (in Finnish target: _blank) |

| Self-employed persons’ pension insurance (YEL) | Self-managed | Opportunity to acquire through the service | Opportunity to acquire through the service |

| Other insurances | Self-managed | Not included | Not included |

| Resale of products | Yes | No | Yes |

| International invoicing | Possible | Yes For EU area businesses only. | No |

| Construction industry invoicing | Possible | Yes | Yes |

| Entrepreneur deduction in taxation | Yes | No | Yes |

| VAT and tax returns | Self-managed or according to the accountant's price list | No need | Included in the service |

| Handling of prepayment taxes | Self-declared and payable | According to the tax card The service pays taxes to the Tax Administration. | According to the tax percent The service pays taxes to the Tax Administration as an additional prepayment at the end of the year. |

| Age limit | With parental permission as a minor. | 18 years | 18 years |

| Adding expenses | Possible through your own bookkeeping. | Not possible | Yes |

| Construction work | Yes | Yes For private and businesses. | Yes For private and businesses. |